The broad economic recovery continues to project strength in the equity markets for the next several quarters, but the recent news cycle has been dominated by fears of Inflation. Rising inflation has put a significant strain on the fixed income markets and that is doubly troubling to investors who often look to fixed income in their portfolios for protection and a safe harbor from volatility. In our view, inflation is not just a buzzword that will soon pass, we believe it is a real concern that must be managed carefully, notwithstanding current news cycles.

Let us remember that while Inflation is real and currently growing, it is not new and is perfectly normal for the market to cycle from deflation to inflation and everywhere in between. At this point, we agree with the Fed in thinking that the threat is a bit overstated. While it is true that the money supply is higher and the Consumer Price Index is up compared to this time last year, the news likes to compare the current numbers with a time 12 months ago when prices were falling dramatically. It is also reasonable to assume some of the recent price increases and pressure that is driving inflation are due to supply chain issues that should be transitory.

But before we experience significant inflation, we must first see small doses of inflation. And that is what we see when we look out at the markets today. While the Fed may not be too concerned for the long-term outlook, we are taking careful measures here with our fixed income allocations to best be prepared.

Looking forward to the remainder of this year, bonds will not be driving much of the growth in the portfolios. With yields currently low and rates projected to rise, we are not expected to see the mid-to high single digit returns many people have grown to expect with fixed income. But if we manage our expectations, there is still a benefit to investing in this space. We still will own bonds to “smooth out” our investing experience and protect our portfolios in the case of a correction to the equity markets. And yet, there are things we are doing to allocate our portfolios to best align our client’s goals with the marketplace we see today.

Here are several ways we combat rising inflation in our portfolios.

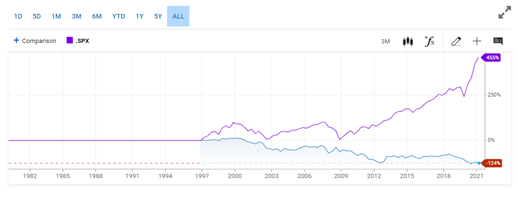

First, we continue to invest in equities. Equities are the most obvious hedge to rising inflation because the value of stock is best suited to keep up with rising inflation. Since 2003, when the 10-year TIPs yield has been 0.5% or less, the stock market has gained an average of 23.8% annualized. When it has been 0.51% or more, then the market has returned 4.5%. The 10-year TIPs currently yields -0.86%.1

Second, we shorten the duration of our fixed income positions. We forecast that rising inflation will necessitate rising interest rates. Duration refers to the term or “due date” of the bond. The shorter the duration, the less the price of the bond moves as rates change. If the one of the primary goals of fixed income is to be non-correlated and less volatile than the equity markets, we do not want to be purchasers of bonds that are most affected by rising rates.

Third, we make sure the credit worthiness of our bonds is high. While bonds are traditionally “safer” than equities, not all bonds are created equal. Some are rated as higher risk than other due to the issuer’s credit worthiness. Inflation can be a real threat to issuers with less credit worthiness and so we will rotate towards those investments with the highest credit quality to protect the investment and provide a safer investment experience.

Fourth, we will look to alternative asset categories in the market to provide further insulation from inflation and rising rates. Real estate remains one of the strongest non-correlated asset categories from both stocks and bonds and the yield remains strong. But even in the fixed income space, there are many underutilized subcategories like mortgage-backed securities, floating rate securities and funds who utilize active management to move from investments on one side of the yield curve to the other to protect against interest rate risk.

If you would like to hear more about our fixed income outlook or our philosophy in general about constructing risk-based portfolios for our clients, please do not hesitate to reach out. And if you know of someone who could benefit from a second look or conversation about their financial goals and plans, please have him or her reach out. We are always more than happy to help friends or family make smart and reasonable financial decisions.

Citations