Typically, the cracks are seen before the financial markets take a hit. This time, nature didn’t just whip up a localized natural disaster such as Katrina, or a tsunami or even an earthquake; it tossed a hand grenade without borders, across the globe. Within weeks, the world as we know it has slammed the pause button.

Many of you have hard earned, hard saved capital invested in the markets. Capital you depend upon for retirement. Capital that defines your standard of living and your life pursuits. In many respects, your quality of life itself is dependent upon this and many are understandably worried about the future.

I have been managing wealth for clients for many years. I watched and learned from Oct 19, 1987; I worked through the tough financial years in the early 90’s. I watched the Dot Com crash with horror and helped people pick up the pieces – their savings. And I will never forget the banking & housing crisis that decimated the markets in late 2008. All were teaching and learning moments. And there was a common thread through most of these “resets” on valuation in the markets. Eventually, most stocks recover – some, faster than others of course. But industry restarts, manufacturing resumes and companies move forward. But truthfully, some companies never develop into more than a shell of their former self.

Some of the greatest investors in the last 40 years, people I have worked for, known (the likes of Marty Whitman, Peter Lynch, and David Alger) and people I have listened to for years, such as Berkshire Hathaway’s Warren Buffet have a common approach to putting money to work in the capital markets:

- Develop a thesis and stick to it, and

- Know what you own.

I believe every one of us needs a core philosophy before we invest one dime in the market.

Mine is fairly simple: If you seek growth, and most of us do, focus at least 60% of your capital to companies that:

- Sell goods that are in demand with a good net profit margin

- Perform better than their competition, and

- Carry a strong balance sheet

We make of list of these companies by looking at mid- to large-cap companies with a long track record of paying a consistent dividend and ranking them by the percentage of growth in what is actually being paid out to shareholders each year.

We discover that the names on the list have goods that are in demand, sell them consistently and pay investors well for the rights of owning shares. These companies rebound when the unexpected happens. And the unexpected will always happen. That is the condensed version of how I have learned to build and maintain a solid equity portfolio.

History tells us this approach to investing for growth works, and works well. In our clients’ portfolios, we own selective strategies that meet these criteria, be it individual stock selection, or through disciplined ETFs.

The remainder of the portfolio should be used for a combination of opportunistic investing or reducing volatility through real estate of perhaps selective fixed income investments. But what matters is defining a well thought out “Investment Philosophy” that is simple, transparent and actionable.

And so why am I reiterating our Investment Philosophy in light of this new Coronavirus?

Time will tell what path we travel before we get to the other side of this tragedy. Time also will show us what the other side will look like; surely it will be different. But time, however long it takes, will put us back on a track where we will continue to grow, live, thrive and hopefully (likely) prosper. Much of how any one individual comes out of this process will be determined, in no small part, on the sustainability of their savings. I believe it is fair to say those who know what they own, and own financially strong, profitable, market dominant companies will likely fair better than many. For even if those companies find it necessary to adapt, they will be the ones with ability to do so. Others may not be so fortunate.

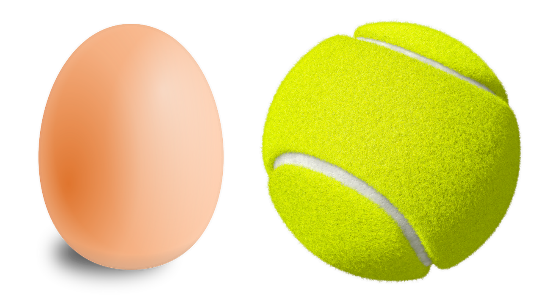

Think of the strong companies as a tennis ball and others like an egg. When a crisis occurs and markets fall, the tennis ball will bounce off the ground while the egg will splatter.

We will bounce back from this unexpected hit to the market. I have seen this before and I know that if you are serious about long term growth in your portfolios, using an investment philosophy that has been proven over time is the solution. Like it or not, there will always be a future surprise. How you prepare for it will define your success.

Please do not hesitate to call our office – (781) 246-0222 – at any point during this time.